It is because I know how sweet and happy and pure the home of honest poverty is, how free from perplexing care, from social envies and emulations, how loving and how united its members may be in the common interest of supporting the family.

Andrew Carnegie, The Gospel of Wealth (1889)

The generosity of the oppressors is nourished by an unjust order, which must be maintained in order to justify that generosity.

Paulo Freire, Pedagogy of the Oppressed (1968)

At first glance, it seems impossible that charity can be a contentious topic. After all, charity is, well, charitable. Benevolent and altruistic and bountiful and gracious. Right?

Eh. It depends on what kind of charity we’re talking about.

The word “philanthropy” has Greek roots. Philos means “loving” or “fond of”; anthropos means “human being” or “mankind.” Thus, by strict definition, philanthropy means the love of humanity or the fondness for humankind. (The opposite of our word “misanthropy,” which comes from misos—“hatred”—and anthropos to mean the hatred of humanity.)

Yet it seems to me that the popular usage of the word “philanthropy” today means something a lot more specific, something to the effect of: filthy rich guys giving away some of their money to pitiable poor people.

Similarly, the word “altruism” comes from the French word autrui, meaning “of others” or “other people.” The English word “altruism,” then, signals a focus on the well-being of others and, what is more, taking concrete actions that are intended to help someone else. That is, actions serving to benefit those others who are in some kind of need.

Yet it strikes me that, in our popular usage of the world “altruism,” we more or less conflate it with our common concept of “philanthropy” (i.e., rich people giving away cash).

Thus, Warren Buffett (approximate charitable giving $62 billion), Bill Gates and Melinda French Gates (combined approximate charitable giving $47.7 billion), George Soros (approximate charitable giving $32 billion), and Michael Bloomberg (approximate charitable giving $21.1 billion) are all altruistic philanthropists who are wondrously magnanimous in their compassionate donations (see here; for a list of the top 100 philanthropic foundations worldwide, see here). And, yeah, that’s great. As we used to say back when I was in college in the deep south, “That’s mighty white of you.”

But “altruism” also has a deeper sense: acting for the benefit of others without expecting any benefit or reward in return. In fact, when you get down to the brass tacks of what’s called Biological Altruism, acting for the advantage of others necessitates causing a disadvantage for yourself.

In evolutionary biology, an organism is said to behave altruistically when its behaviour benefits other organisms, at a cost to itself. The costs and benefits are measured in terms of reproductive fitness, or expected number of offspring. So by behaving altruistically, an organism reduces the number of offspring it is likely to produce itself, but boosts the number that other organisms are likely to produce. (Italics added)

I think it safe to say that Warren, Bill and Melinda, George, and Michael are incurring no such biological disadvantage for themselves when giving away their billions of dollars. Nor are they incurring any real financial disadvantage to their vasty fortunes. The plain fact of the matter is that a billionaire philanthropist, as a biological organism, IS NOT engaging in charitable actions “at a cost to itself.”

Quite the contrary. Charity benefits the wealthy giver far more than it does the impoverished receiver. The former gets to look like a swell person and maintain his or her economic and social privilege. The latter may get tossed a needed crumb, but in the end is only further locked into her or his economic and social deprivation.

The concept of noblesse oblige (“nobility obligates”) is among the most pernicious inventions of the well-to-do. Whether applied within the medieval ideology of divine-right aristocracy or the modern ideology of cut-throat capitalism, the idea of people of great wealth and high social status having the responsibility and meeting the obligation of acting generously toward those less fortunate than themselves is bullshit and gaslighting of the first order.

Such “charity” is an act of violence. Such “generosity” is a strategy for oppression.

Wealth in America Today

In his detailed historical research, French economist Thomas Piketty has found that over the past few centuries of capitalism in Europe and the United States, wealth inequality always has been extremely high. Notes Piketty:

The most striking fact is no doubt that in all these societies, half of the population own virtually nothing: the poorest 50 percent invariably own less than 10 percent of national wealth, and generally less than 5 percent (p. 257).

Meanwhile, the top 10% of the population in all these societies generally own more than 60%—and sometimes up to 90%—of national wealth (p. 259). According to the latest available data (through 2024 and into early 2025), here’s what the wealth distribution currently looks like in America.

— The top 10% of the population own 67-69% of total wealth. Within that top 10%, the top 1% own 30-31% of that total wealth.

— The next 40% of the population (that is, the 50th to 90th percentile) own about 27-30% of total wealth.

— The bottom 50% of the population own a bit less than 2.5% of total wealth.

(Sources: The Federal Reserve Board, The St. Louis Federal Reserve, The U.S. Census Bureau, Congressional Budget Office, Pew Research Center)

Numbers like these obviously call for a whole lot of noblesse oblige.

Wealth inequity in the U.S. has been on the rise for the past four or five decades—and there looks to be no end in sight to this trend. The share of wealth going to the top 1% and top 10% has increased significantly during this period. Unsurprisingly, the share held by the middle class (that next 40%) has stagnated and generally declined. As usual, the bottom 50% remain in the economic shitter.

Some of the main factors contributing to this wealth inequity are what you might expect.

Disparities in earned income—from absurdly low “minimum wage” salaries to a whole lot of people working jobs that bring a non-living wage (and forget healthcare benefits) to corporate executives and CEOs “earning” astronomically obscene salaries.

Asset ownership and inheritance—affluent folks enjoy income-generating assets such as stocks, real estate, and retirement accounts that all help to accumulate family wealth, which they then pass down to their children.

Debt—the tighter your budget the more you are forced to borrow, with levels of household debt in America now at an all-time high.

Tax policies—let’s just face facts, the tax policies of the Republican Party since Reagan have all been designed to stuff money hand-over-fist into the pockets of the already richest Americans.

Systemic racism—yeah, all that WOKE and CRT stuff that exposes how historically disadvantaged racial and ethnic groups are impeded by laws and policies from a fair shot at accumulating wealth.

In short, the state of Wealth in America today is an uphill battle for anyone who isn’t already flush with cash.

Charitable Giving in America

Armed with this snapshot of wealth inequity in today’s America, let’s take a look at charitable giving in our country. Who typically contributes to charities and at what amounts? (Sources for the following information: Nonprofits Source, National Philanthropic Trust, Define Financial, Philanthropy Roundtable, Giving USA.) Or, to ask the more exact and important question for our exploration into domestic philanthropy and altruism:

Who in America, in terms of economic class, displays a love of humanity (philanthropy) by engaging in giving dedicated to the well-being of others (altruism) that comes at a cost to themselves?

It comes as no surprise that, in terms of absolute amount donated to U.S. charities, the wealthy class gives the most. In 2023, for example, individual donors accounted for 67% of total giving to the amount of $374.4 billion. The sheer volume of this giving points to substantial contributions coming from the higher-income brackets. Equally, mega-gifts from a small number of extremely wealthy individuals make up a significant portion of total individual giving each year.

Moreover, affluent donors often use structured giving instruments such as donor-advised funds (DAFs) or private foundations to curate the timing and targets of their giving. Wealthier donors tend to focus more on arts, culture, universities, and healthcare organizations—that is, generally already well-off causes and institutions. The wealthy also take advantage of tax incentives for charitable giving at a much higher rate than the income groups below them, itemizing their donations as deductions.

Finally with regard to the rich folk, while over 220 billionaires globally (many of these in the U.S.) have signed a “Giving Pledge” to donate half of their wealth either while alive or after they die, over 70% of billionaires on the Forbes 400 list have donated less than 5% of their wealth to charitable causes. Similarly, while the total lifetime giving of the top 25 U.S. billionaires has been on the increase, reaching $241 billion in 2024, their rate of giving decidedly has not kept pace with the growth of their fortunes.

In sum, no doubt it is a lovely gesture for these superrich individuals to be giving to charitable causes. Even their considerable contributions, however, hardly come at a real cost to themselves. In fact, as I argue below, their brand of charity serves primarily to maintain the status quo of their privilege and to mask the excess of their socially destructive greed.

Turning now to lower- and middle-income individual donors, these Americans give a larger proportion of their income to charities. Some studies find that the lowest 20% of income earners donate a greater portion of their income than the top 20%. Likewise, middle-income households give a bigger share of their discretionary income to charity compared to higher-income households.

For example, the Tax Policy Center reports that households making less than $50,000 annually are the second-highest givers in terms of percentage of income. Meanwhile, households making between $100,00 and $500,000 a year come in last when it comes to their giving in relation to their gross income.

The fact is, the vast predominance of charitable giving in the U.S. comes from average citizens of moderate income. Six out of ten American households donate to charity in a given year; their typical annual gift adds up to between $2,000 to $3,000. In their giving, these donors prioritize basic human needs—food, clothing, housing, and so forth—over donations to higher-brow activities such as arts, culture, and colleges.

What is more, rarely can these donors take advantage of tax incentives for charitable donations. Although they give generously, they can’t afford to give enough to make their total itemized deductions exceed their applicable standard deduction.

In sum, average Americans display more sincere philanthropy and engage in more genuine altruism than do billionaires tossing around their ostentatious amounts of money. The donations of lower- and middle-income people come at a palpable sacrifice to their household budget. Nor is it likely that these folks give to charity in a spirit of feel-good, guilt-alleviating tokenism or as a subterfuge motivated by self-interest.

In fact, I’d venture to guess that the reason this group of charitable givers focuses mainly on supplying the basic needs of others is that they know, first-hand, what it’s like to struggle to make ends meet or to be in crushing debt.

Oh, if there were only some way to improve the lot of, well, let’s just go ahead and say 90% of Americans...

What if Billionaires Paid Equitable Taxes Instead?

Sure. I know. What exactly does “equitable” mean, anyway? That’s a floating signifier if there ever was one.

Even so, I’ll just go out on a limb here to say that, whatever the hell “equitable” means, it sure the hell doesn’t mean that 50% of the American population own less than 2.5% of the national wealth.

Is that a close enough working definition of the word for you?

When it comes to their income taxes, billionaires routinely do not pay an equitable share from their yearly earnings. That’s because, by way of their enormous political influence, billionaires shape U.S. tax policy. (Just look at the unprecedented number of billionaires currently in Trump’s cabinet or working in his administration.) A 2021 study carried out by American Progress found that billionaires on the Forbes 400 list paid, from 2010-2018, an effective tax rate of 8.2%—which is a much lower rate than many middle-class Americans.

Another analysis from 2021, this time carried out by ProPublica, arrived at the same findings. Namely, that there is a significant gap between the wealth growth of the superrich in American and the lower tax rates they pay. Moreover, addressing this disparity would result in considerably higher tax revenue for public use (for example, see here).

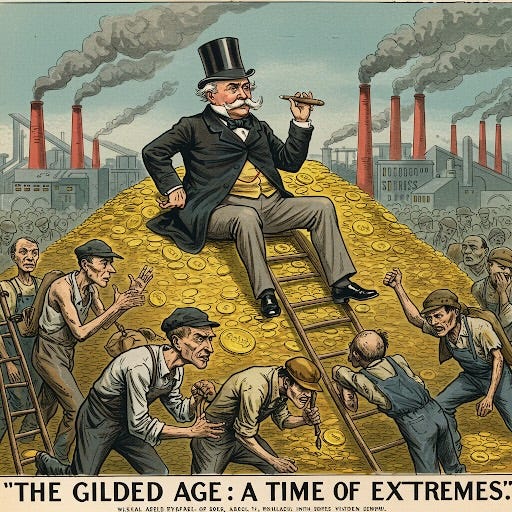

More recently, economist Gabriel Zucman, in a 2024 New York Times Guest Essay titled “It’s Time to Tax the Billionaires,” explains how, for the first time in U.S. history, billionaires pay a lower effective tax rate than working-class Americans. He also points out that today, when it comes to total wealth accumulation, “the superrich control a greater share of America’s wealth than during the Gilded Age of Carnegies and Rockefellers.”

So the superrich have rigged the game in their favor when it comes to paying income taxes.

But wait. Let’s put a cherry on top of this shit pie. The super-wealthy are also quite adept at another form of tax avoidance. That is, outright tax evasion.

The EU Tax Observatory publishes a yearly Global Tax Evasion Report. In 2024, this report found that, worldwide, the superrich pay a miniscule effective tax rate of between 0% and 0.5% of their total wealth. This chicanery is made possible both by their exploitation of numerous tax loopholes and by their hiding capital in offshore accounts.

Great. And so how much potential tax revenue is being lost every year, worldwide, as a consequence of this tax dodging?

In 2024, the Tax Justice Network estimated that cross-border tax abuse, both by wealthy individuals and by multinational corporations, costs nations around the globe approximately $492 billion in lost revenues per year.

Damn. And so how much potential tax revenue is being lost every year here at home, in the Land of the Free and the Home of the Brave?

In April 2025, Oxfam reported that, in America, “The richest 1% are already responsible for nearly 30% of all unpaid taxes—amounting to $205 billion annually. That’s $562 million in unpaid taxes per day, or $6,500 every second.”

OMG.

As if these numbers aren’t contemptible enough, Oxfam further estimates that the cuts to the IRS being proposed by billionaire Musk and billionaire Trump “would allow ultra-rich tax cheats to steal $30 million per day through unlawful tax evasion.”

Holy monkey.

In a 2016 presidential debate with Hilary Clinton, Trump did not deny that he’d paid no federal taxes for a number years. In fact, Trump quipped, “That makes me smart.” When the New York Times was able to conduct an analysis of Trump’s tax returns in 2020, they found not only a record of chronic losses for his businesses, but years of tax avoidance.

Can we stop fooling ourselves? Tax evasion is not being “Free” or “Brave.” Tax evasion is not savvy financial wheeling-and-dealing.

Tax evasion is theft.

Is There a Better Way to Tax Billionaires?

Yes. It’s called a progressive wealth tax.

While, of course, billionaires should pay—and I mean actually pay—their income taxes at a fair rate, only taxing billionaire salaries is, in fact, missing the whole point of equitable taxation.

Billionaires should also pay an annual tax on their total wealth.

Why?

Because an income tax is far different than a wealth tax (also called a capital tax). Income is your yearly inflow of earnings from employment. Wealth (or capital) is your total stock of accumulated fiscal goodies—that is, nonhuman assets that can be owned and exchanged on some market. Such assets might include money in bank accounts, stock market investment portfolios, real estate, rents collected, business investments of various kinds, retirement accounts, and so on.

Obviously, billionaires have a lot of such goodies. Often too many to name or to track. Moreover, this total stock of accumulated wealth is the secret sauce of being a billionaire.

How so?

Because even though billionaires often pull down mega-salaries as CEOs, their yearly earnings from interest on capital investments far outperform their earnings from employment income.

Another way to put this is that billionaires, unlike most of us, live off of their wealth, not their income.

A U.S. Treasury Report from 2024 sets out a case that, contrary to popular belief, the super-wealthy are not necessarily undertaxed when it comes to paying their income taxes—that is, if they refrain from engaging in tactics of tax evasion. Especially when their foreign business tax burdens are added in (boo-hoo), the superrich pay a goodly share of their salaried earnings. However, the same report also makes clear that “most governments, foreign and domestic, tax people and businesses on their income and not their wealth.”

And that distinction is at the heart of the matter when it comes to billionaires paying their fair share in taxes. Accumulated wealth enables you to accumulate a lot more wealth. In fact, Thomas Piketty characterizes this fiscal phenomenon as “The First Fundamental Law of Capitalism” (pp. 52-55). That is, the more capital you have to invest, the more capital will come your way via the rate-of-return on those investments.

This Fundamental Law is especially true because, as Piketty shows, interest rates (which determine your rate-of-return on investments) have run much higher than economic growth rates (which influence your salary level) throughout the history of capitalism. On average, interest rates outstrip growth rates at a clip of about 4-5% to about 1-2% (pp. 99-102, 206-209).

At a certain point, then, it becomes pointless for billionaires to be doing anything so quaint as earning a salary from employment. Their enormous piles of wealth bring home not just the bacon but the whole hog. At this point, perforce, they join the Robber Baron Oligarchy Club.

Many billionaires also decide that it would be best if they take over the politics of their country. Or even the whole world. How better to protect their accumulated wealth and the system that allows their accumulated wealth to make even more accumulated wealth?

Be honest here. Before the Trump 2 Regime, you’d have taken these statements to be fevered flights of Marxist fancy.

So what’s to be done? Simple. Democracy must control capitalism; markets and financial instruments must be regulated. This is the major conclusion of Piketty’s book (pp. 571-573). This is the upshot of the Fighting Oligarchy Tour organized by Bernie Sanders and also featuring Alexandria Ocasio-Cortez. A key tool in this crucial endeavor is a wealth tax. Underscores Piketty, “The right solution is a progressive annual tax on capital” (p. 572).

Needless to say, reining in the 50-year stampede of neoliberal plunder and greed will be no easy task. In the first decades of the 21st century, wealth inequity—that is, the staggering financial gap between the superrich and everybody else—has reached unparalleled proportions. With it, inevitably, has come the Second Gilded Age.

Robber Barons once again rule the roost. If not checked, if not defeated, their authoritarian oligarchy could well prevail. Their well-heeled totalitarianism could well become permanent.

Maybe it already has. Maybe it already is.

To be continued in 2 weeks...

AND DON’T FORGET...

Read some provocative fiction. Check out and subscribe to my other Substack newsletter, 2084 Quartet at:

While you’re at it, read some provocative social commentary. Check out and subscribe to this absolute Substack gem as well:

Once again you absolutely nailed it! I have been arguing this since Trump 1.0. It weighs on me every day.

Utterly sobering take on the USA